PRODUCT OR SERVICE

Seamlessly facilitate EFT payment processing by connecting to North America’s banking system

EFT / ACH

Product Guide

June 2021

Table of contents

PAGE

SECTION 1 – Product Introduction

About VoPay & Overview 3

Product Service Benefits 4

EFT / ACH Payment Security 5

SECTION 2 – Accounting/ Operational Details & Requirements

Reporting 6

Processing Times 7

Cut-off Times 7

Transaction & Cancelation Statuses 8

Error Codes 9

SECTION 3 – End User Details & Requirements

Originator IDs 11

Pre-Authorized Debit (PAD) Agreement Requirements 11

Varying Recurring Payments 11

EFT / ACH Payment Information Requirements 12

Payment Disputes 13

Product Guide: EFT / ACH

SECTION 1 – Product Introduction

About VoPay:

VoPay’s Payment as a Service (PaaS) solution is designed to allow businesses to utilize local, regional and global payment options through a single open API to meet all their payment needs and much more. The complexity of moving funds between different providers is all handled by VoPay ensuring a seamless experience for all users.

Overview:

VoPay’s EFT / ACH payment service enhances the current legacy EFT / ACH payment service that moves $125 trillion of business payments globally. It is an electronic payment type that allows you to debit from or deposit payments straight into another bank account. You can set up one time or recurring EFT / ACH payments to:

- Send payments directly to a vendor or supplier.

- Collect payments directly from a client or customer without sending anything through the mail.

Product service benefits:

EFT / ACH payments are usually faster and more secure than checks, wires, or credit cards. EFT / ACH payments are also more convenient for you and your vendors or customers. The payment is taken directly from the payers’ bank account and deposited in the recipient’s bank account, which means there is no need to print or sign anything, make a trip to the bank, or pay off a credit card bill later.

When can I use it?

EFT / ACH payments are ideal for businesses that want to make payments to another organization quickly, that have a lot of recurring bills, or that tend to deal with the same vendors and clients on a regular basis. For instance, rent collection, membership fees, and payments for regular shipments from the same supplier are all more streamlined with EFT / ACH payments.

How does it work?

Customizable Payment Flows

Send

Initiate direct bank payments to send money to users or service providers.

Receive

Debit any bank account with complete visibility throughout the transaction lifecycle with account and balance verification.

Mass Payments

Pay, debit, track and reconcile payments to/from multiple customers.

Combination

Use a combination of all payment flows to meet your clients needs.

EFT / ACH payment security:

EFT / ACH payments are a safe way of making payments. While it may feel odd giving away your bank account information, remember that the same information is available on a check. You’ll never need to make a stop payment on checks that were lost or stolen in the mail since EFT is all handled electronically. It’s also more difficult for fraudsters to make off with your money if you use EFT payments because EFT payments are not immediate, meaning you can cancel them within a limited timeframe.

VoPay EFT / ACH advantages compared to traditional EFT / ACH:

- You can integrate our API (endpoints available here) into your billing, account receivables/payables, payroll or payment provider platforms or you can access the payment service directly through the VoPay client dashboard

- Both our API and VoPay client dashboard allow for fully automated bulk payments

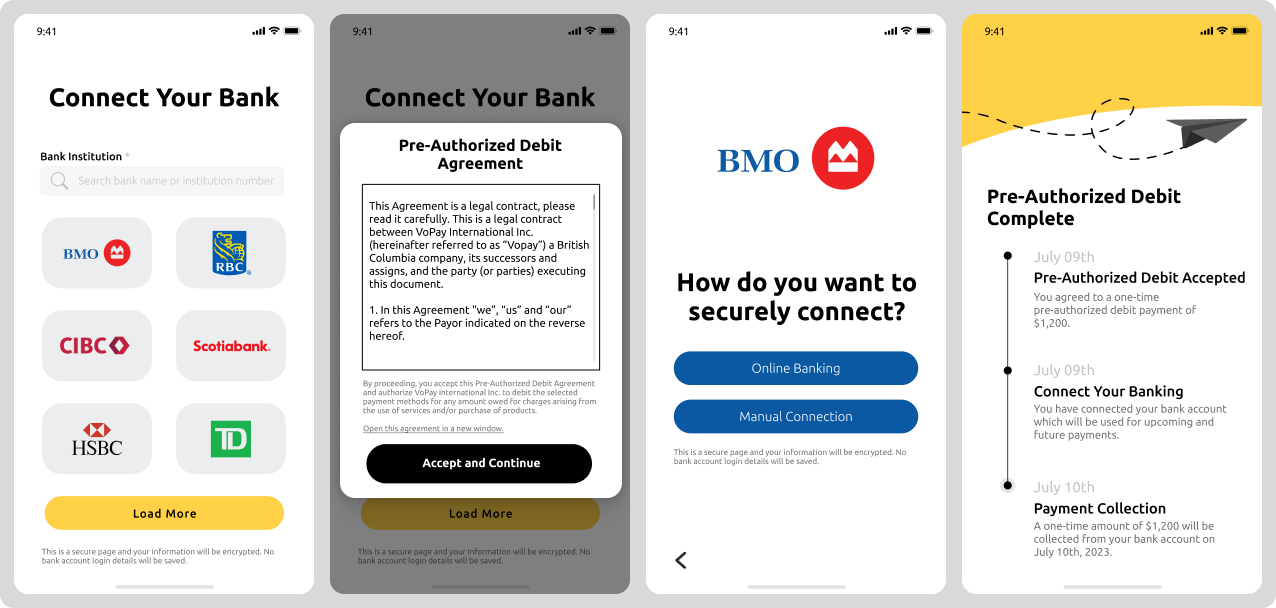

- Our technology can be fully customized to match your brand

- A 100% paperless and mobile-first experience

SECTION 2 – Accounting/ Operational Details & Requirements

Reporting:

To access a real-time report of all transactions you can log into the VoPay client dashboard, go to Statements and Reports on the left-hand side and then go to Transaction History.

Key Definitions:

Account Balance: These are total funds including your pending balance and security deposit.

Pending Balance: These are incoming EFT/ ACH funds (collection of funds) that have a 3-5 day hold applied.

Security Deposit: These are funds you were required to provide as part of your agreement.

Available Balance: These are total available funds (Account balance – pending balance – security deposit = available balance).

Reporting data is also available through our API and more information can be found here.

Processing times:

Once an EFT / ACH transaction is initiated it will follow the following timeline:

- Collecting payment: T + 3 business days for funds to arrive

- Sending payment: T + 3 business days for funds to arrive

Transaction cut-off times:

Electronic Fund Transfer (EFT) Transaction Cut Off Time

(CAD or USD dollars destined to Financials institutions in Canada for EFT)

“Cut Off Time” is the recommended latest time on a Business Day, as advised to you from time to time, by which we must receive your Debit or Credit Instructions in order for us to process them on the payment due date. The cut of time depends on the destination of the financial institution and the currency being used.

The payments are only processed or settled on business days. A business day is any day other than Saturday, Sunday or a Federal statutory holiday. For more details on US/Canadian statutory holidays please visit Holiday Calendar: https://vopay.com/holidaycalendar.

Please note that if the payment date falls on a non-business day, then the transaction is processed on the next business day. You can adjust your payment schedules to settle on the business day before or after the holidays.

There are three daily cut-off times to submit EFT payments:

Description

Eastern Standard Time

Pacific Standard Time

Deadline to receive the transaction

Transaction submission for processing

Deadline to receive the transaction

Transaction submission for processing

CAD or USD dollars destined to Financials institutions in Canada for EFT

6:00am EST

7:00am EST

3:00am PST

4:00am PST

CAD or USD dollars destined to Financials institutions in Canada for EFT

1:00pm EST

2:00pm EST

10:00am PST

11:00am PST

CAD or USD dollars destined to Financials institutions in Canada for EFT

6:00pm EST

7:00pm EST

3:00pm PST

4:00pm PST

Automatic Clearing House (ACH) Transaction Cut Off Time

(USD dollars destined to Financials institutions in the United States for ACH)

“Cut Off Time” is the recommended latest time on a Business Day, as advised to you from time to time, by which we must receive your Debit or Credit Instructions in order for us to process them on the payment due date.

The payments are only processed or settled on business days. Please note that if the payment date falls on a non-business day, then the transaction is processed to your customer’s account on the next business day. You can adjust your payment schedules to settle on the business day before or after the holidays.

A business day is any day other than Saturday, Sunday or a Federal statutory holiday. For more details on statutory holidays please visit Holiday Calendar: https://vopay.com/holidaycalendar

There is one cut-off time to submit ACH payments:

Description

Eastern Standard Time

Pacific Standard Time

Deadline to receive the transaction

Transaction submission for processing

Deadline to receive the transaction

Transaction submission for processing

USD dollars destined to Financials institutions in the United States for ACH

6:00pm EST

7:00pm EST

3:00pm PST

4:00pm PST

Transaction and cancellation statuses:

Below is a list of transactions status for payment, from start to finish:

Stage

Status

Description

Stage 1

REQUESTED

Transaction initiated

Stage 2

PENDING

Transaction approved by VoPay

Stage 3

IN PROGRESS

The transaction is being processed by the bank

Stage 4

SUCCESSFUL

or FAILED

Funds have cleared or transaction was unsuccessful (see Return and reversal statuses below)

Stage 2

CANCELLED by VoPay

Transaction cancelled by VoPay’s risk team after it’s been REQUESTED

Stage 3

CANCELLED by Merchant

Transaction cancelled by the merchant before it goes into IN PROGRESS

Error Codes:

Below is a complete list of return and reversal codes if a transaction fails. It may take up to 5 business days for a 901 NSF (Non-Sufficient Funds) return code to be returned from the bank.

Code

Returned Item Reasons

900

Edit Reject

901

NSF

902

Cannot Trace

903

Payment Stopped/Recalled

904

Post/Stale Dated

905

Account Closed

907

No Debit Allowed

908

Funds Not Cleared

909

Currency/Account Mismatch

910

Payor/Payee Deceased

911

Account Frozen

912

Invalid/Incorrect Account No.

914

Incorrect Payor/Payee Name

915

PAD No Agreement Existed – Business/Personal

916

PAD Not In Accordance with Agreement – Personal

917

PAD Agreement Revoked – Personal

918

PAD No Pre-Notification – Personal

919

PAD Not In Accordance with Agreement – Business

920

PAD Agreement Revoked – Business

921

PAD No Pre-Notification – Personal

990

Institution in Default

Below is an example of a failed code due to returned transactions and errors are returned when you hit the endpoints, the response will be displayed as is shown below.

There are also errors displayed in the web-hooks notifications in the format mentioned below.

For more information about webhooks, please visit the link here.

SECTION 3 – End User Details & Requirements

Originator IDs:

You have the ability to set the short and long name (originator ID) for each account during the account creation process in your VoPay account:

- Short Name: This will be the company name that appears on the users’ bank statement and can be up to 15 characters in length

- Long Name: This is the full company name and can be up to 30 characters in length

Pre-Authorized Debit (PAD) agreement requirements:

You’ll need a Pre-Authorized Debit Agreement, or PAD, which is an agreement between you and your customer that enables you to debit accounts on a recurring basis without getting permission each time. These agreements are great because they remove several steps from the process and help you ensure that your payments always arrive on the same day. A PAD agreement is also required for one-time payments.

Below are the terms and conditions that every user must agree to before using the VoPay EFT / ACH payment service:

- Personal PAD Agreement Terms & Conditions: vopay.com/personal-pad-terms

- Business PAD Agreement Terms & Conditions: vopay.com/business-pad-terms

Varying recurring payments:

For variable amounts PADs at set intervals (e.g. monthly), you need to notify the customer at least 10 days before each payment, unless you and your customer mutually agree to reduce or waive this “pre-notification” period in the payor’s PAD agreement. The waiver has to be prominently displayed in a paper agreement (e.g. in bold print, highlighted or underlined), or expressly communicated to your customer in the case of an electronic agreement.

EFT / ACH payment information requirements:

A user will be asked to enter their bank account information along with their name and address to initiate the transaction. Below is the bank account information a user will need to provide to complete an EFT / ACH payment:

Canadian Cheque:

- Account number: See above

- Transit number: See above

- Institution number: See above

American Check:

- Account number: See above

- Routing number: See above (combine the institution number and the transit number)

Payment disputes:

If an EFT / ACH payment isn’t in accordance with the terms of the payor’s PAD agreement such as the wrong date or amount or if no agreement exists it can be disputed by the payor.

If your customer can’t resolve the issue with you or if they wish to contact their financial institution first, they can make a claim for reimbursement. They can do this up to 90 days after the payment. Once the customer gives the reason for their claim, their financial institution will reverse the PAD and restore the funds to their account, resulting in the funds being taken from your account.

Dispute Process

The dispute process is governed by the H1 rules of Payments Canada. Please visit the link below for more information about the dispute process. Please see Part VII – Reimbursement and Recourse (page 17) and Appendix III for reimbursement claims by a customer (page 34).

https://www.payments.ca/sites/default/files/h1eng.pdf